Domino Effect Economics

DOMINO EFFECT ECONOMICS FOR IMPORTED HARDWARE – For countries that rely on independent and dealership import entities to bring in electronic consignments, ever so often we see the fluctuating of hardware prices. Most of it happens for the good of the consumer, as a prevailing market item’s price will almost certainly be lowered after some time.For example, a stick of 4GB ram that cost you $65 two weeks back now goes for $45,that’s a sharp dip,on a relatively “cheap” piece of technology. What happens behind business doors, is 9 out of 10 import houses losing money, and the tenth player making a little more,all in the name of competitive struggle.We call it the domino effect,clichéd,but apt.

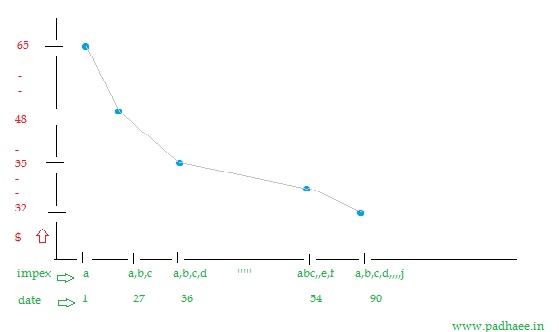

To express this graphically,consider 10 importers, independent and in-house,all vying for the same hardware product,that has just been made commercially available by manufacturers oversea at a price of $28.

Say,each importer receives 1000 pieces of the said product at a width of 5 days apart,after which it comes into the distribution network and resellers in the local market 4 days later.

=>A. impex. is the first to reach the market,sets price at $65 against cost of $28 at which product was procured.(all 1000 pieces are sold to the distributor at the same price in one lot)

=>B.impex learns of $65 market price and decides to set their price lower at $63.this forces A.impex also to lower to $63,(for their next incoming consignment)Now $63 is the new price on the market.

=>C.impex receives their consignment and decides to work on less margin, and sets price at $60 to check competition. quickly A.inc and B.inc react,settling their new price on par with c.inc.(for their next incoming consignments)New market price is now $60,with all three importers selling at that price.everyones cut profits.

=>domino effect continues till J.impex. sets market price to $32,which is stabilized,with no further reduction. All importers now work on a meager margin of 14.2%,till the manufacturer shows reduction in cost of hardware prices,which will happen when next stage in product deveopement arrives.

A few observations-

=>In a period of 90 days(9*10),gross profit margins for importers reduces from 132% to 14.2%,that’s how congested and competitive the technology sector is.

=>Assuming there are 100 independent distributors in the national network, A.impex would require 10 times more efficiency to get its goods absorbed into the market after 81 days of saturation

=>In reality,each impex would randomly buy at irregular intervals,and hardware prices could drop occur much sooner.In some cases impex companies start off prices at a lower price band inorder to flood the market

=>net loss occurs if for example h.impex estimates and decides to sell at $36 against prevailing price of $38,and at the same time manufacturer reduces cost price to $25,and because of domino effect markets correct to $29,h.impex wont be able to sustain on $1 gross profit,it would be a loss.

That is my analogy of domino effect economics for imported hardware , just a short jist of a few points that can be mentioned,just outlining the broad structure of how hardware prices can fluctuate so easily. So the next time you go out and rejoice pondering why the price of your favorite drive or motherboard has become so cheap, remember the people behind it, and the amount of money that has been lost to make you smile.