Education loan in india for study abroad requirements

Education loan in india for study abroad requirements – In order to get an education loan in India from a bank, the procedure is quite simple. The first step is ensuring that your loan is sanctioned without any complications, for this ensure that all the required documents from the list are kept ready in advance.

If u wish to see my actual bank statement of the education loan you can click here.

For my education loan bank remittance process click here

Before you apply for an education loan,here are some points to take note of:

1.Other charges-A small one time fee at time of sanction

of education loan maybe levied on the customer known as the processing fee,which is equal to 1-2 % of the loan amount. On the other hand id you wish to foreclose the loan by making payments in advance a fee called as prepayment fee is charged to the customer. It is in the range of 3-4% of outstanding amount .

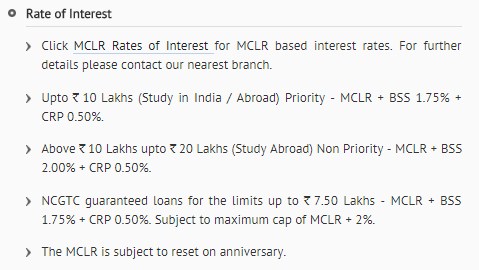

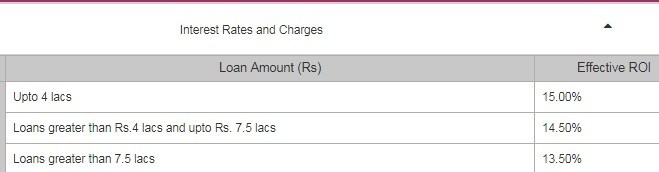

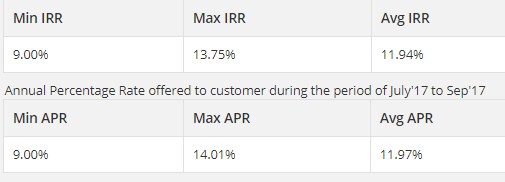

2.Interest Rates vary from 11% to 15% p.a by most city banks.

3.Tenure of loan can be anywhere from 5 to 7 years

4.Most loans are for a minimum amount of 50,000.Maximum

amount is in the range of 10-15 lacs for studying domestically and 20-25 lacs for international studies

5.All banks offer a grace period of 1 year after completion of a course or 6 months after getting a job, whichever is earlier.After which your monthly EMIs will begin.

6.Its important for Indian students who avail loans for

domestic colleges to check if the institute has credentials with UGC or AICTE,if not if will be harder to get the Education Loan sanctioned.

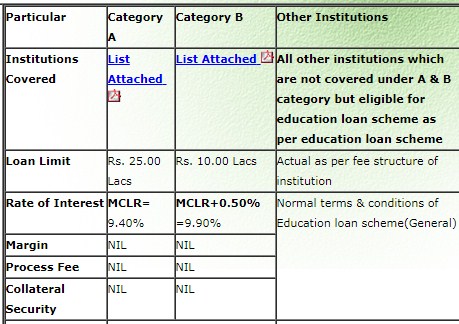

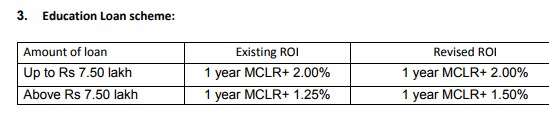

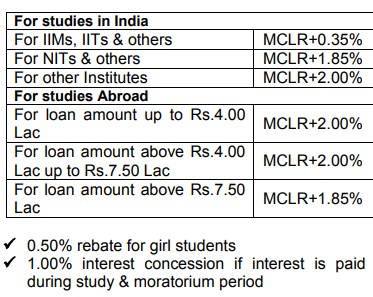

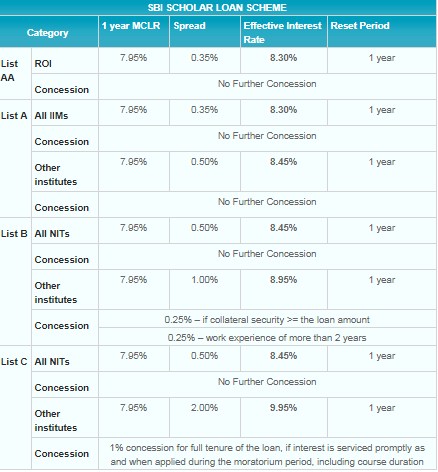

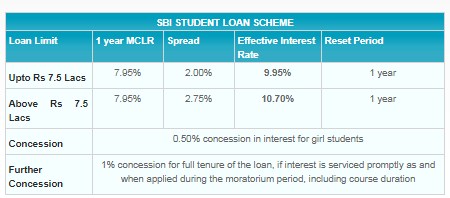

EDUCATION LOAN INTEREST RATES

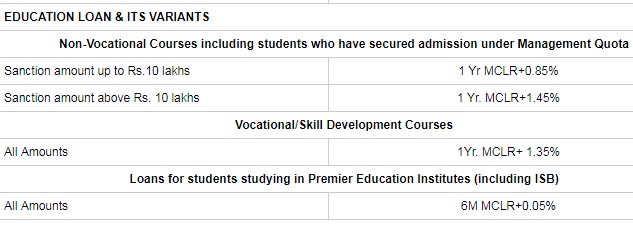

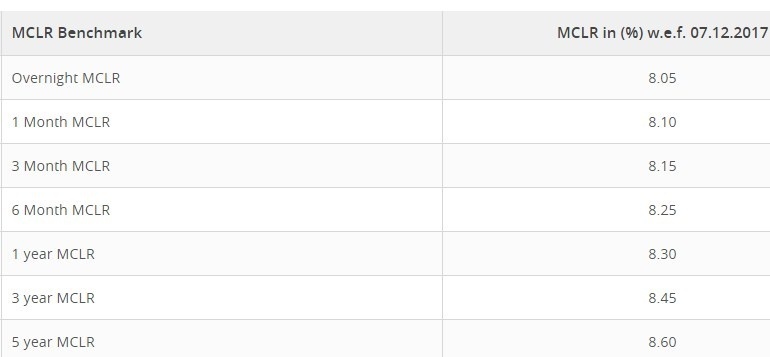

IDBI BANK

BANK OF BARODA

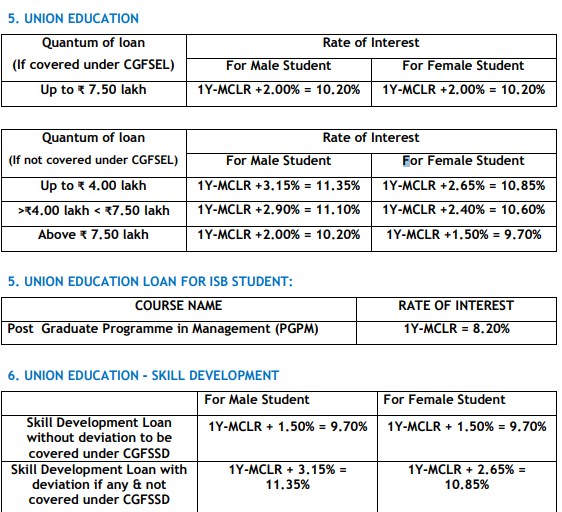

UNION BANK OF INDIA

CENTRAL BANK OF INDIA

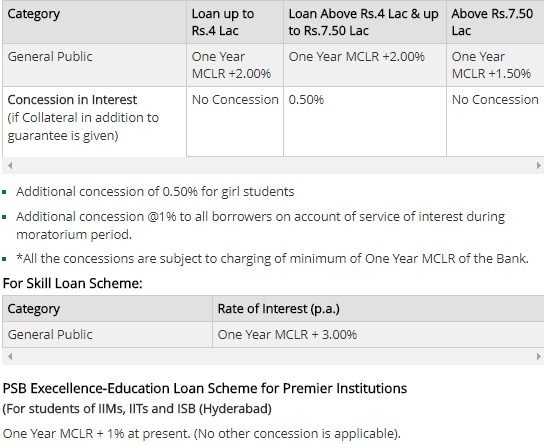

PUNJAB AND SINDH BANK

TAMIL MERCANTILE BANK {TMB}

ORIENTAL BANK OF COMMERCE

BANK OF MAHARASHTRA

ALLAHABAD BANK

AXIS BANK

STATE BANK OF INDIA SBI

HDFC BANK

Education loan in india for study abroad requirements

MARGIN MONEY

Most banks ask the customer to put up a certain amount of money toward the loan, which is known as margin money. If margin money is 50% on a loan of 10 lacs means that the customer puts up 5 lacs and the bank puts 5 lacs. Every remittance will be 50:50,there will never be a time when the bank

will remit an amount more than the amount you put up.

As a norm, margin money is asked if the loan amount in question is above 7.5 lacs and margin % ranges from 10-20 % depending on the bank.

EDUCATION LOAN in India DISBURSEMENT

For Education Loan, Funds are disbursed directly to the university by providing the banking information and swift code number of the University, This remittance is for the tuition fees, and a detailed periodic disbursement chart has to be given to the bank in advance, the bank will disburse the funds accordingly. Depending on the terms of Education loan, it may be used to cover other payments besides tuition fees like examination fees, books, laptops travel expenses etc. All these payments and other personal expenses may be disbursed at regular intervals.

CO-APPLICANTS/GUARANTORS

It is important for anyone associated with the loan to have a good source of income, as most loans may require to be supported by a primary or secondary co –applicant. For loans higher

than 7.5 lacs banks will also ask for a guarantor. A salaried person is always a good bet as they will have to furnish their salary slips along with other financial details like house papers and bank information.

DOCUMENTS for education loan

1.For salaried people-applicant or co-applicant, latest two salary slips and offer letter from company

2.Latest 6 months bank statements

3.Age proof

4.Identity Proof

5.For Self employed people-Last 2 years ITR papers, audited balance sheet of profit and loss, bank statements

6.Residence Proof

7.Completely Filled Application Form

8.Offer Admission Letter from University along with all Course details.

9.Passport size photographs

TAX BENEFITS

As per the UGC norms, under section 80E,a maximum limit of 40,000 per year maybe deductible. This is only after repayments have commenced on the Education Loan and may carry on for 8 years. These apply only for courses at graduate and post graduate level may be eligible for tax rebate.

Hi, this is great post! im looking for low interest loans also thnks