Aliexpress India Customs charges

Aliexpress India Customs charges – If you are buying items from Aliexpress.com to India,in most cases there will be customs charges associated with it during the customs clearance procedure.There are many chinese websites that Indians are buying from and avoid paying duty and taxes on it.

Contents

- 1 Aliexpress India Customs charges

- 1.1 Do we have to pay customs for aliexpress?

- 1.2 How is customs charges calculated?

- 1.3 Can you avoid customs by marking it as a gift?

- 1.4 Which courier is best to avoid customs charges?

- 1.5 Can you pay customs charges in COD?

- 1.6 How long can a package stay in customs ?

- 1.7 Why is my package stuck at customs?

Aliexpress India Customs charges

Do we have to pay customs for aliexpress?

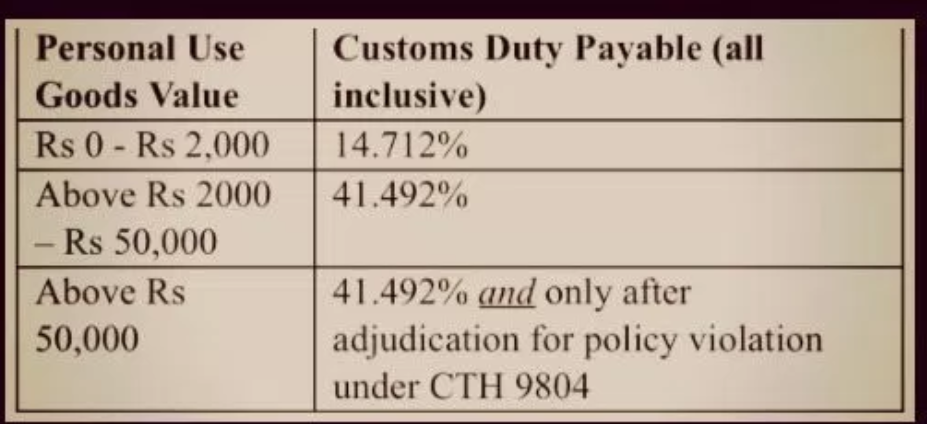

Yes,as per the new rules shown below according to the slabs below,your total CIF (Cost,Insurance,Freight) value:,but there are few exceptions to this

So what does this mean?Even if you buy something worth $5 on Aliexpress will you have to pay customs?The answer is yes,but it depends.According to my experience,if you buy something so cheap like 5$ – $10 or even $15 you will almost NEVER be charged anything extra – especially if the products you are purchasing are apparel,kitchen,garden items etc.

For electronics it is a bit ricky,but here also if it some cheap mobile accessories,or spare parts for a camera etc which has a low CIP value,you wont be paying anything extra.

How is customs charges calculated?

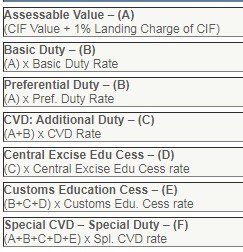

Customs duty is calculated on the CIF value of the product.Each product has a specific HS Code.This HS Code corresponding to each product has a basic duty associated with it.Other duties and cess as shown below:

To calculate your approximate customs charges go here

How is duty exactly calculated see here

Can you avoid customs by marking it as a gift?

Upto a product value of Rs.5000 a “sample” or “gift” marked package can avoid any customs charges.However the government is getting strict about this as there is alot of misuse and is considering removing this rule.

Since the last 10 years,all the sellers on Aliexpress are directly asking you ‘ if you want it marked as a gift?’In order to circumvent this problem CBEC has directed to scrutinize all packages,especially electronics goods.They are going to implement a few things:

=They are considering removing this customs waiver on “gifts”

=They are going to allow only upto 4 packages per year per person who are buying for personal use.

Which courier is best to avoid customs charges?

On of the best ways to assure that you wont be charged customs duty is to buy cheap products – below $10.BUt suppose you want to buy a little more expensive item.One of the ways that i have noticed is to use the free shipping method of Hongkong post or china post as compared to paid shipping via Fedex/DHL/UPS etc.

What happens here is that if at all there is some customs to be paid,then your local postman will charge you separately for it,but chances are less unless its a mobile or value above CIF 2000.BUT in case of paid couriers,they will pay the customs immediately at the airport itself and then charge you later for it.These paid couriers are also scrutinized more by customs officials.

So remember to ensure you want customs free goods you have to:

- Order products below rs.2000 – lower the better.

- Use only free shipping methods

- Choose small package post,and opt for soft envelope package instead of hard corrugated box with larger volume and dimensions.In small packet post they almost never open the package to check it,but in boxes chances are higher that they might open.

Its important to note that you can also order a sample of a product and this can also be treated as a gift and will not attract duties.If you have an IEC license then you can buy upto 10* samples in a year and not be charged duty on them.

Can you pay customs charges in COD?

Yes you can.You cannot pay for the actual product in cash on the Aliexpress.com website,but now they are allowing Indian Debit cards.Previously only credit cards were allowed,now there are lots of digital wallets,paypal and other options for payment.

The way to pay cash on delivery (COD) for ONLY your customs charges is directly to the postman or courier person who arrives at your doorstep.

the reason for this is simple – The customs charges are calculated after arrival at the international airport.Now this could be done two ways.On the invoice amount or the assumed amount.If the customs officer feels the product is under invoiced he/she will assign a different value to the product and calculate customs charges on that.This is the reason you cannot pay for it beforehand.

If it is Indian postal service then you have to give in cash this amount or even if you order through a private courier like Fedex or dHL etc.But if you have an account with Fedex then you can pay it later and it does not have to be in cash.

How long can a package stay in customs ?

There are minimum two customs sorting facilities in every major city.One being in the city centre and other at the international terminal of the airport where the cargo is offloaded.All packages are examined and dispatched within 5 business days.

The only reasons your package will be kept behind is if it is a prohibited item or if there is some irregularity with the value of the goods.If you imported through a private courier like Fedex and DHL,they will pay the customs duties and taxes on it according to the value accessed or set by the customs officer,and will bill you for the same.

Why is my package stuck at customs?

The main reason why most of the packages get stuck at the customs office is because of duty payable on it.They will ask you to come to the office and make the payment on it.IF you do not agree to the assessed value they have assigned to it or are not agreeable to pay the duties and taxes then they will auction off the goods within the stipulated time period.

Lots of people are purchasing mobile phones,digital cameras and drones.The customs charges on these items are about 40% of the value of product which is very steep.Many people who do not know about the customs charges buy it from Aliexpress and later get a call from the customs office.At this point,many of them find the customs charges too high and some decide to not accept the package.

Another reason why your package maybe stuck at customs is if it a prohibited item due to which it will be seized and you will get notice OR if the item is a duplicate which has a copyright infringement violation.